Regulations are complex.

Reporting shouldn’t be.

Stay compliant with continuously updated taxonomies, consistent outputs, and minimal manual intervention.

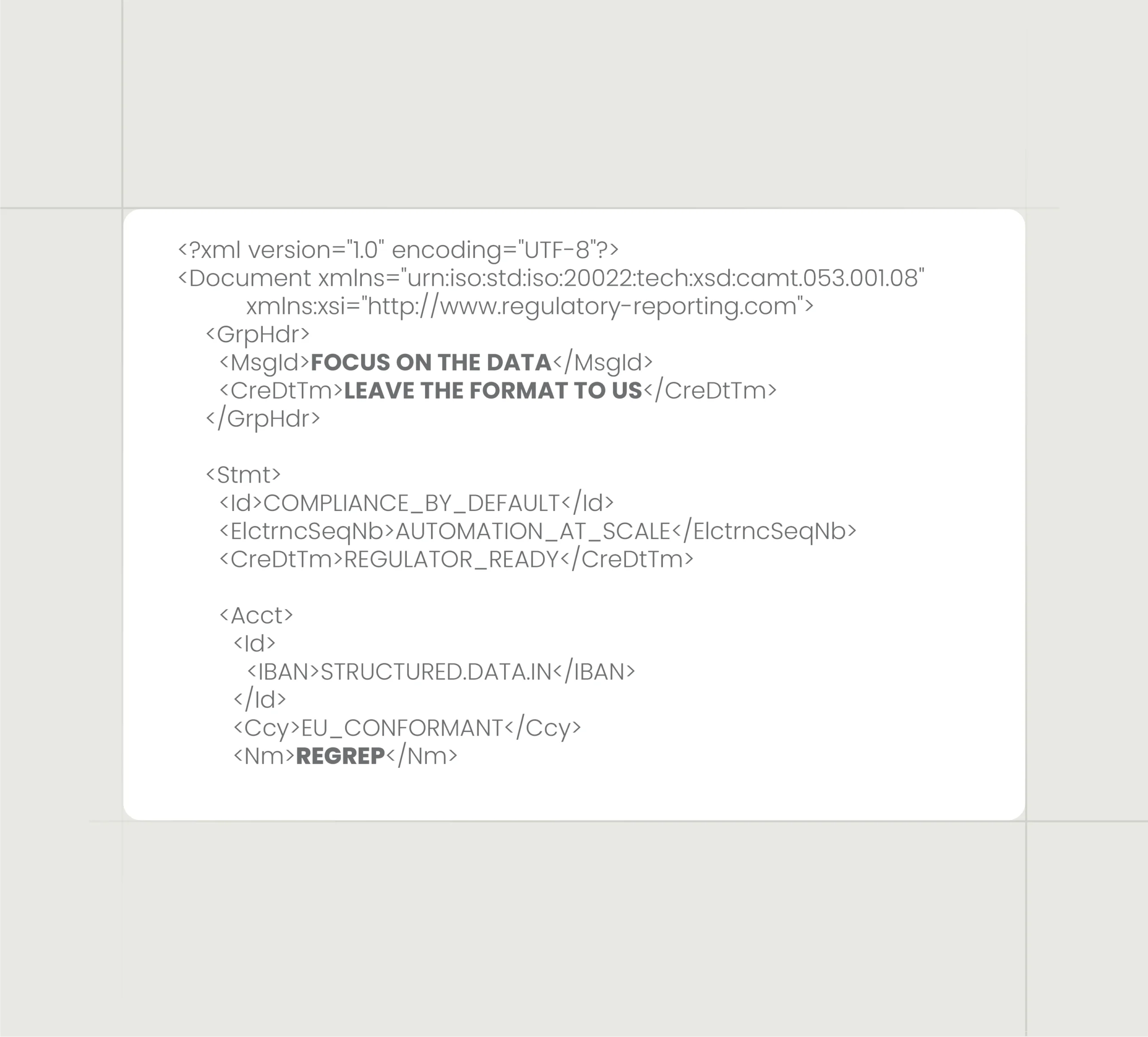

Focus on the data.

Leave the format to us.

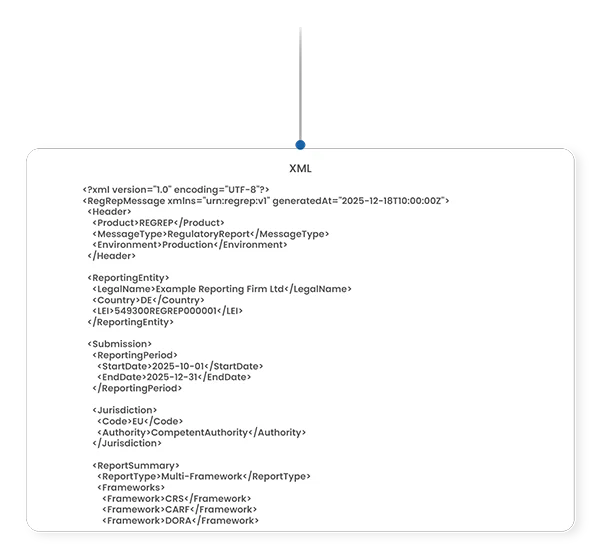

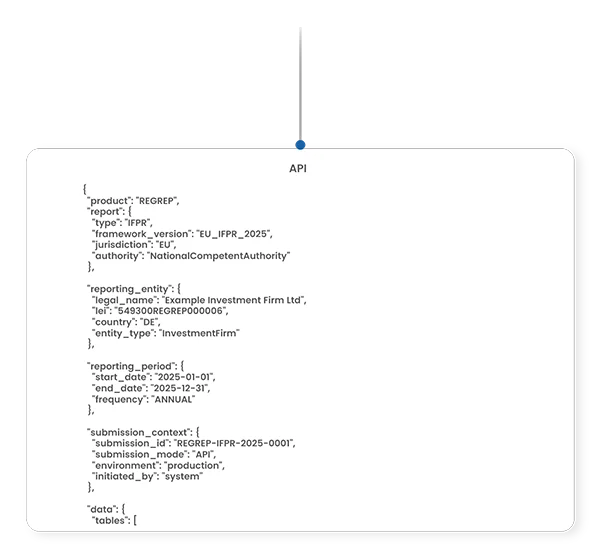

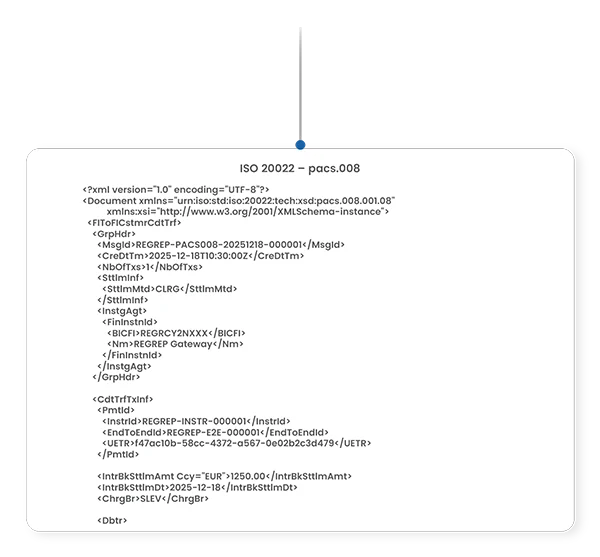

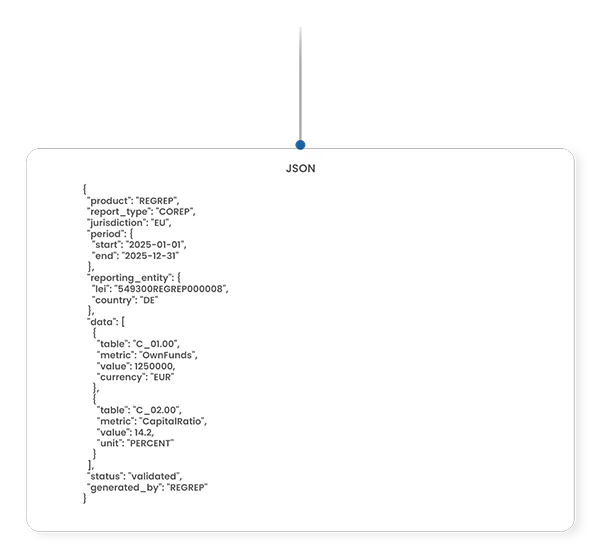

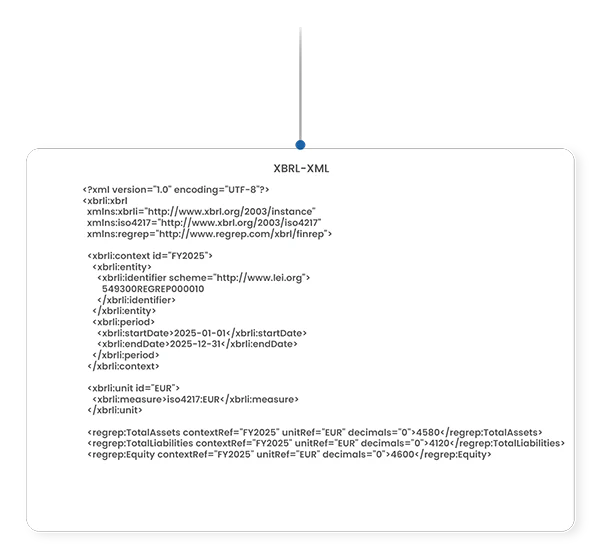

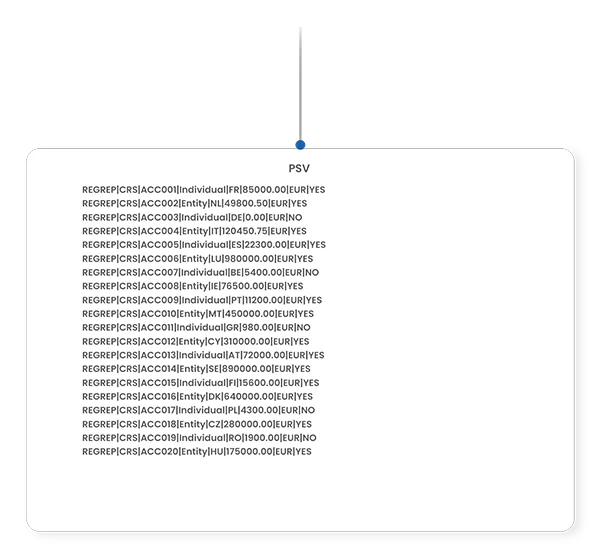

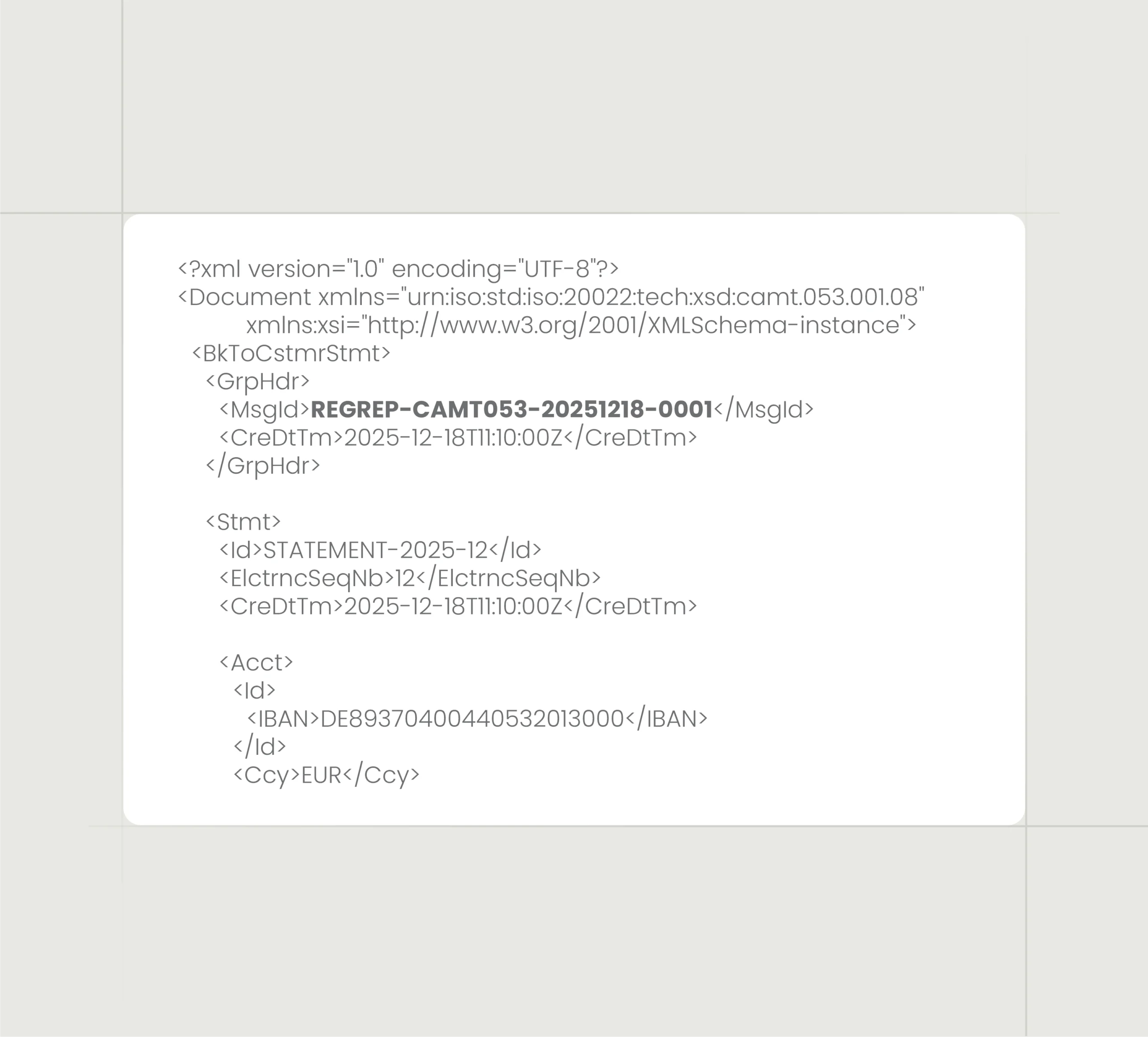

Automated transformations deliver consistent XBRL, XML, JSON, PSV and CSV outputs — validated and aligned with the latest frameworks — so your team can focus on analysis, not admin.

Eliminate manual formatting, reduce errors, and deliver submissions on time.

All regulatory outputs are generated in the correct format, validated, and kept aligned with the latest regulatory frameworks.

REGREP use cases

Effortless Regulatory Returns

Automate COREP, FINREP, and statistical reporting by converting accounting, risk, and exposure data into EBA-compliant XBRL outputs with built-in taxonomy handling and validation checks.

Capabilities used:

End-to-End IFR/IFPR Compliance

Automate IFR/IFPR prudential metrics and reporting by calculating K-Factors and key capital and risk indicators from accounting, trading, and exposure data, with audit-ready traceability and submission-ready templates.

Capabilities used:

Cross-Border CRS / DAC2 / AEOI Filing

Generate jurisdiction-specific CRS submissions with automated schema and validation checks. Identify missing or inconsistent data early and produce tax-authority-ready outputs across cross-border operations.

Capabilities used:

Built for modern regulatory reporting teams

REGREP is designed to support organisations responsible for complex, multi-framework regulatory reporting, including:

-

Investment firms subject to IFR / IFPR

-

Financial institutions reporting under EBA and national frameworks

-

Fintechs, CASPs, and regulatory reporting service providers

Products

Transparent pricing for individual modules and regulatory engines.

REGREP capabilities by regulatory area

EBA REPORTING FRAMEWORK

XBRL Converter

Validate and convert EBA templates into ready-to-file XBRL-CSV in minutes.

DIGITAL OPERATIONAL RESILIENCE ACT

DORA Register of Information

Evidence and track your ICT TPP in one place.

EXCHANGE OF FINANCIAL INFORMATION (AEOI / CRS / FATCA / CARF)

AEOI / CRS / DAC2

Validate, convert and export CRS files per tax authority for more than 20 jurisdictions.

CARF / DAC8

Reporting for Crypto-Asset Service Providers.

FATCA

Report under the US Foreign Account Tax Compliance Act.

Global TIN Validator

API-ready TIN checks to clean and validate investor data.

RISK & CAPITAL REQUIREMENTS

Pillar 1 (Minimum Capital Requirements / CAR)

Automated calculation engine for IFR/IFPR capital calculations, reporting and monitoring.

Pillar 2 (ICARA Report)

VaR based report engine for your ICARA under IFR / IFPR (MIFIDPRU).

Pillar 3 Disclosures

Prepare Pillar 3 disclosures aligned to your data.

Security and compliance are our foundation

Designed from the ground up to safeguard customer data, REGREP adheres to industry-leading security and privacy standards and is working towards SOC 2 Type II and ISO 27001 certification.

Frequently asked questions

Below are answers to common questions about REGREP and how it supports regulatory reporting teams.

Free your team for what matters.

REGREP supports IFR, CRS, DORA, MICA, and EBA supervisory frameworks, enabling regulated institutions to generate, validate, and submit reports through a unified platform.

Start free, or talk to us about enterprise reporting workflows.